Condo Insurance in and around Colorado Spgs

Looking for great condo unitowners insurance in Colorado Spgs?

State Farm can help you with condo insurance

Welcome Home, Condo Owners

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Colorado Spgs. Sorting through deductibles and coverage options is a lot to deal with. But if you want competitively priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Colorado Spgs enjoy unbelievable value and no-nonsense service by working with State Farm Agent Kendra Gries. That’s because Kendra Gries can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as sports equipment, appliances, pictures, linens, and more!

Looking for great condo unitowners insurance in Colorado Spgs?

State Farm can help you with condo insurance

Agent Kendra Gries, At Your Service

When a blizzard, vandalism or theft cause unexpected damage to your condo or someone falls on your property, having the right coverage is important. That's why State Farm offers such wonderful condo unitowners insurance.

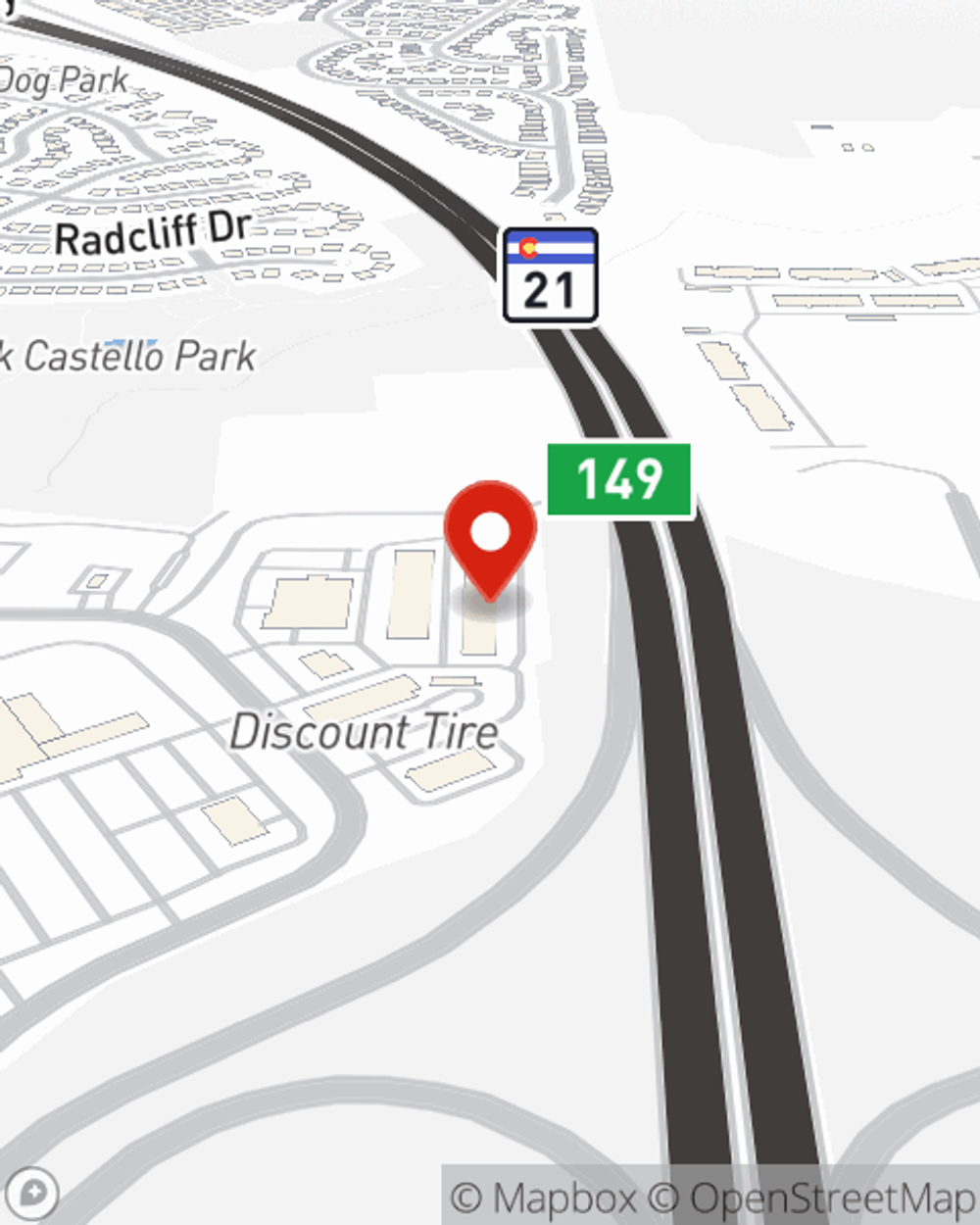

There is no better time than the present to reach out agent Kendra Gries and discover your condo unitowners insurance options. Kendra Gries would love to help you find a policy that fits your needs.

Have More Questions About Condo Unitowners Insurance?

Call Kendra at (719) 359-9506 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Kendra Gries

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.